One of China's biggest supermarket chains is to begin selling New Zealand wines from Sileni Estates in a move that will help its range to be more affordable for middle class drinkers.

Image: Ole' supermarket of China Resources Vanguard, credit CRC

Image: Ole' supermarket of China Resources Vanguard, credit CRC

Sileni wines will be sold at prices between RMB198 to RMB298 through high-end supermarket chains, Ole’ and blt, which are owned by state-controlled China Resources Vanguard Co. Ltd (CRC).

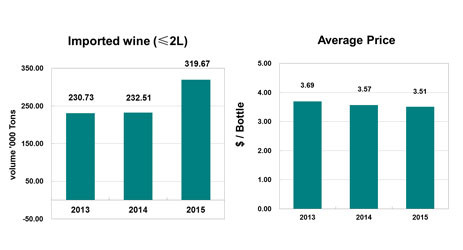

Chinese wine imports have shown signs of a rebound in 2015, despite ongoing government austerity measures, and this has being driven by more affordable wines and younger consumers.

‘We wished to secure national distribution with a retail group who we could work with directly to help train their sales staff on an on-going basis,’ said Sir Graeme Avery, CEO and president of Sileni Estates.

‘China Resources Vanguard have a new Ole’ and blt store roll-out programme over the next several years.’

After entering the Chinese market in 2007, the New Zealand winery is also working with specialist sales channels including Enoteca, he told DecanterChina.com.

Custom figures show that the average price of New Zealand bottled wines imported to China is $10.51 per litre (Jan-Sep, 2015), significantly higher than the general $4.62 per litre average price of wines entering China.

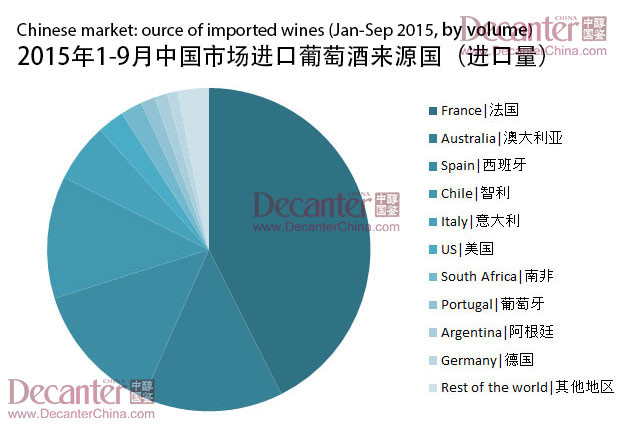

Fresh figures show that China’s wine import market has rebounded strongly in volume and value in the first nine months of 2015, driven by French and Australian wines.

‘We see greatest growth currently (appears) at price points below those of New Zealand, especially in online channels,’ said the CEO.

‘Retail channels that fit our price points,’ therefore, is considered more appropriate for the New Zealand producer, who ‘prefer a slow and steady approach’, he said.

The CRC group currently own 30 Ole’ supermarkets and 15 blt (short for ‘Better Life Together’) supermarkets in 17 cities in China, including Shanghai, Beijing and Shenzhen, targeting the middle class consumers.

70% of products sold at Ole’ chains and 40% at blt chains are imported goods, according to CRC.

The China Resources Vanguard bought all 135 of Tesco’s retail stores in China in 2014, which now account for part of the group’s 4000 shops in the Mainland and Hong Kong.

(Edited by Chris Mercer)

All rights reserved by Future plc. No part of this publication may be reproduced, distributed or transmitted in any form or by any means without the prior written permission of Decanter.

Only Official Media Partners (see About us) of DecanterChina.com may republish part of the content from the site without prior permission under strict Terms & Conditions. Contact china@decanter.com to learn about how to become an Official Media Partner of DecanterChina.com.

Comments

Submit