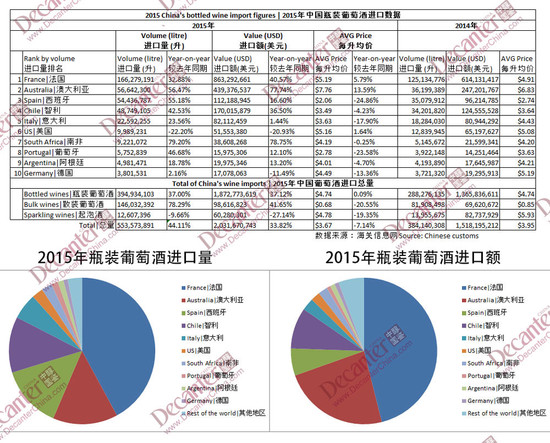

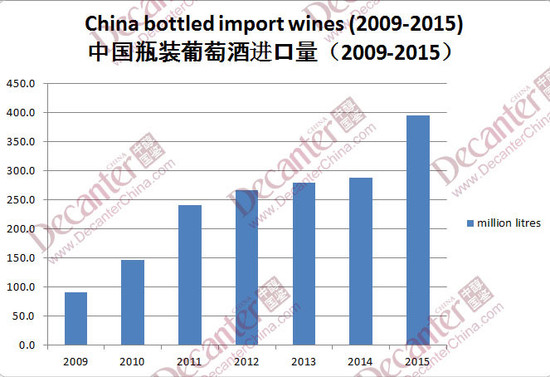

China’s bottled wine imports in 2015 jumped by a third in both volume and value compared to 2014, the biggest increase since 2011 and emphasising signs of a recovery in the market, show customs figures.

After showing growth in the first nine months of 2015, bottled wine imports in China continued to rebound in the last three months of 2015, reaching a total of 395m litres by the end of the year, a 37% increase versus 2014.

Total Import value was up by 37% year-on-year to reach US$1.9bn, meaning that the average price of import bottled wines remained mostly the same (if not slightly increasing) compared to 2014.

Despite the general slow-down of economic growth and the volatile stock market, China as a wine market appears to be regaining its vigour since the end of 2012, when it was initially hit by the government austerity drive.

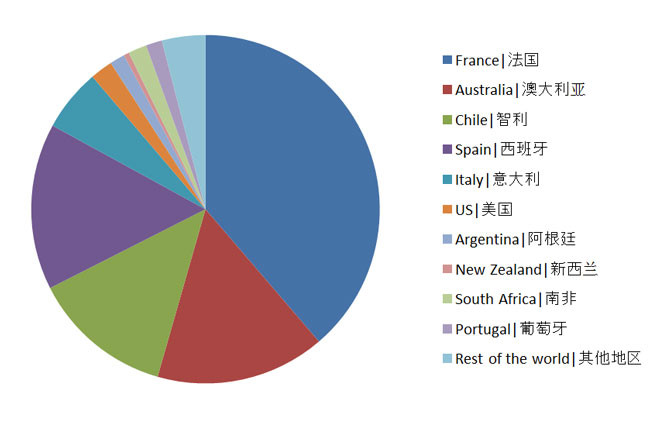

By the end of 2015, China imported 166m litres of bottled French wines, up by 33% than 2014. The import value is also up by 41%, fetching US$863m.

France remained as China’s primary source of imported bottled wines in 2015, responsible for 42% of the total volume and 46% of the total value.

The positive effect of the China-Australia Free Trade Agreement (ChAFTA) signed in May 2015 continued to bring strong growth to bottled Australian wines in both volume (57%) and value (78%) year-on-year.

The average price of bottled Australian wines consequentially raised 14% to reach $7.76 per litre, highest among the top 10 source countries of imported wines in China.

China is expected to overtake UK and become Australia’s second largest wine export market by value in the next 12 months, Wine Australia chairman Brian Walsh told Decanter.

The ChAFTA states that in the year 2019, China will abolish the import tariff on Australian wines in full.

Although 55% more bottled Spanish wines were imported into China in 2015, the average price dropped by 25% year-on-year to $2.06 per litre.

Continue to benefit from the price advantage brought by the FTA with China and the market needs for more affordable wines, Chilean wines showed an annual growth of 43% in volume and 37% in value.

'Our biggest export focus is now on Asia, with particular emphasis on China,' Eduardo Chadwick of Viña Errazuriz told DecanterChina.com, ‘10 years ago, Asia represented 5-6% of our sales by value. Now it is 25% and in the next ten years it will be 50%.'

It is notable that wines from the US, however, suffered a 22% reduction in volume and 21% drop in value.

Although bulk wine import showed year-on-year growth in both volume (78%) and value (42%), the average price dropped by 21%. Sparkling wine also saw a 19% drop in average price.

Trade experts warned that the wine market is no exception from the impact brought by the economic slow-down, and that the food and beverage sector is still far from fully recovered.

All rights reserved by Future plc. No part of this publication may be reproduced, distributed or transmitted in any form or by any means without the prior written permission of Decanter.

Only Official Media Partners (see About us) of DecanterChina.com may republish part of the content from the site without prior permission under strict Terms & Conditions. Contact china@decanter.com to learn about how to become an Official Media Partner of DecanterChina.com.

Comments

Submit