From the beginning of 2011, a leading Bordeaux real estate agent says, an average of one Bordeaux chateau per month has been sold to a Chinese investor.

Asian-owned properties in Bordeaux now number 40 to 50 – a figure that, given the size of the region, is a mere ‘blip on the radar’, estate agent Maxwell-Storrie-Baynes says.

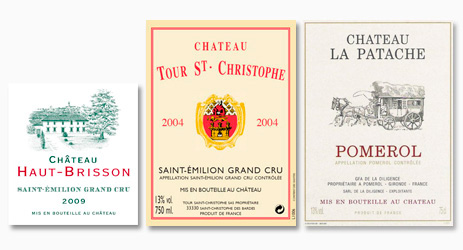

From 1997, when Taiwanese native Peter Kwok bought Chateau Haut Brisson, there have been some 50 chateaux in the Bordeaux region sold to investors from Mainland China, Taiwan, Singapore, and Japan.

The market for Bordeaux properties is so bullish that auctioneer Christie’s has seen the opportunity and is launching a vineyards service targetted at the Chinese, as part of Christie’s International Real Estate.

Maxwell-Storrie-Baynes, which acts as Christie’s Bordeaux affiliate, has compiled a table of purchases since the late 1990s and finds at least 40 chateaux are Chinese-owned.

It says the focus has primarily been on Chinese buyers but it is not always possible to discern exactly where buyers are from.

‘This is because business addresses or indeed the geographical sources of the purchase funds are not always the same as the owners’ [location].’ Some purchasers are building considerable portfolios of property. Cheng Qu, for example, owner of the huge oil-to-real estate Haichang Group, and the driving force behind the Dalian wine festival in northeast China, has just added Chateau L’Enclos in Sainte Foy la Grande, near Bergerac, to his holdings.

He is already owner of ten Bordeaux estates including Chateau Baby (also in Sainte Foy), Chateau Chenu-Lafitte and Chateau Branda. The impetus behind buyers like Cheng – and there are many like him – is the desire to supply increasingly sophisticated Chinese consumers with wine. Within the next five to ten years, it is estimated, the middle class in China will number some 300m and constitute a market larger than the United States.

‘People who are buying Bordeaux chateaux are looking to service that market,’ Maxwell-Storrie-Baynes partner Michael Baynes told Decanter.com.‘Typically, they want to control the supply chain.’

An early adopter of this policy – controlling supply from vineyard to end user – was Richard Shen Dongjun, owner of the 400-strong jewellery retail chain Tesiro, who bought the Medoc Cru Bourgeois Chateau Laulan Ducos in 2011.

A spokesman for Shen told Decanter.com at the time that the idea was to create a chain of stores under the name of the chateau, in cities with a rising wine-drinking culture, exploiting the existing Tesiro network. They would stop selling the wine in France.

There are compelling financial incentives behind such a move. With the cost of production €2-3 per bottle, and the ability to mark up to €30-50 per bottle, ‘it is a nice business prospect,’ Baynes says. ‘One of our clients recouped the price of the vineyard in one year.’

By and large, the Bordelais welcome this influx of investment, although resentment can bubble to the surface. One prominent owner, on selling her estate to a private French buyer said, 'We wanted it to go to another family. We didn’t want it to go to a faceless insurance company or to a group of Chinese investors. We’re very happy that it is going to a family that we have known for a long time, and that we know will look after the estate.'

In Burgundy, the resentment is palpable: the purchase of Chateau Gevrey-Chambertin by Macau businessman and Burgundy lover Louis Ng last year caused a storm of protest. ‘It is a despoliation. Our heritage is going out of the window,’ Jean-Michel Guillon, president of the union of Gevrey-Chambertin wine producers said, just before the ultra-right Front National added its voice.

But Bordeaux is different, Barnes says, pointing out that there are 120,000ha of vines in Bordeaux and 28,000 in Burgundy, of which only 5,000 are of real interest.

‘There’s a totally different reaction in Bordeaux,’ Baynes says. ‘We’re delighted to have the Chinese here. They couldn’t have come at a better time. This region has a long history of foreign investment, from the Irish to the Belgians, the English, Australian magnates, Americans, Brazilians, Saudi princes. It’s nothing new.’

Baynes also notes that in a region of 8,000 chateaux, Chinese owners represent only 0.5% of ownership. ‘In the grand scheme of things they are a blip on the radar.’

- Follow us on Weibo @Decanter醇鉴 -

-

All rights reserved by Future plc. No part of this publication may be reproduced, distributed or transmitted in any form or by any means without the prior written permission of Decanter.

Only Official Media Partners (see About us) of DecanterChina.com may republish part of the content from the site without prior permission under strict Terms & Conditions. Contact china@decanter.com to learn about how to become an Official Media Partner of DecanterChina.com.

Comments

Submit