I just came back from a business trip to the Northeast China. On the dinner tables in Shenyang and Harbin, I was impressed by the brand penetration of Penfolds.

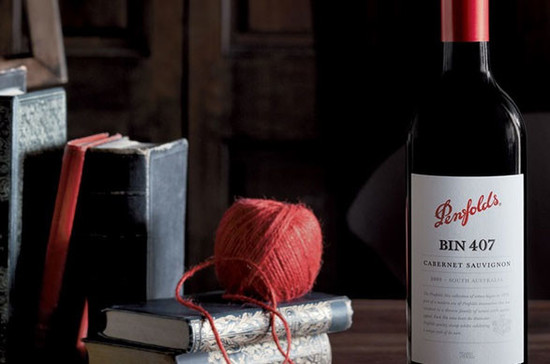

Here is how a gathering at the Northeast works: if there’re 10 people invited to the dinner, we would start with a small case (6 bottles) of Penfolds’ Bin 407, followed by two bottles of Chinese Baijiu (white spirit). If the guests are still not satisfied after these, we would happily finish with some beer.

Why do consumers like it

I spoke to a few local consumers about why they like Penfolds Bin 407 so much. ‘The brand is famous’, ‘the price is not cheap (thus won’t be embarrassing for you to order) but affordable’, ‘satisfactory rich body and flavours’ are among the top reasons that made Bin 407 one of the most ‘solid’ best sellers in this part of China—known for its extravagant drinkers.

Indeed, Penfolds is a brand of great strengths. Especially in China, its position in the market is almost irreplaceable. It sits on the top of the pyramid of both brand awareness and sales.

For me at the moment the only brand that rivals the fame of Penfolds in China is perhaps Chateau Lafite Rothschild. Having said that, with Penfolds’ rich variety of products and deep penetration in the local distribution networks, even Lafite is in for a difficult battle.

The distributors’ dilemma

If a product is liked so much by the consumers, it should usually be the most profitable product for the distributors as well. Interesting enough, however, the distributors of Penfolds are constantly complaining that they’re not making much money.

Their profit margin for a bottle of Bin 407 sold a 400RMB is usually less than 10%. As for the entry level range Rawson’s Retreat, the profit is even lower than 10%.

In my opinion, there’re three key reasons behind this. One is that Penfolds’ price is getting a bit ‘too transparent’ online. Take Bin 407 as an example: The same wine used to be sold at 700RMB (£70) per bottle when it was only distributed by one importer; now the price has dropped to around 400RMB per bottle.

When it comes to festival sales, the price of the Penfolds range is seen as an indicator of how big the sale is. It is not uncommon for online distributors to sell Bin 407 at as low as 300RMB per bottle and use it as a ‘bait’ to attract consumers. If that is the case online, how can distributors dare to ask for much more?

The second problem comes from those ‘uncertified’ distributors. Although Penfolds has approved a few ‘official’ big distributors, it seems almost impossible for them to stop people from importing the range from markets abroad themselves. The producer seems to be trying but not actually achieving much result in stopping this, making it difficult for them to protect the price.

The third problem is the competition among Penfolds’ own brands. Strictly speaking, the most successful products within the Penfolds range are Bin 407 and Rawson’s Retreat, whilst the rest remains almost unknown to consumers. Bin 407 and the so-called ‘poor man’s Grange’ Bin 389 have overshadowed the rest of the series. Even on the same distribution platform, the ‘brothers and sisters’ from the Penfolds family can differ largely in sales.

The Penfolds range has thus become something distributors have to stock. They are left thinking that they’re merely porters of Penfolds, and only being paid for the minimal labour cost.

What if an alternative comes up

I don’t intend to blame the distribution strategy of Penfolds in China. I just want you to hear my assumptions: If all of Penfolds’ distributors start to think that selling these wines brings no profit, it would be only natural for them to seek for an alternative with similar quality and retail prices, but gives a bigger profit margin.

That alternative, if it does exist, would hugely motivate distributors to make a sale.

They would skillfully use the client resources they have built up with Penfolds to promote this wine. For example, they can casually encourage consumers to compare this wine with a Penfolds wine at a tasting event; then they smoothly recommend clients to buy one bottle of this new product when they buy five bottles of Penfolds with an alluring first-time buyer offer. I’m sure as long as the quality of this wine is reasonable, there’s a good change that consumers may be convinced.

Certainly, an ambitious brand like this will need to invest a huge amount of money and time on branding; plus, they would need a skillful operator.

Funnily enough, I think there’s already one emerging brand doing exactly that. The owner is Chinese, and I’m sure he has heard complaints from the end retailers way earlier than me. He is now embracing the ‘gifts’ from Penfolds with everything he has. As far as I can see, there are many followers after him.

Turning off my laptop, I smell war.

Translated by Sylvia Wu / 吴嘉溦

All rights reserved by Future plc. No part of this publication may be reproduced, distributed or transmitted in any form or by any means without the prior written permission of Decanter.

Only Official Media Partners (see About us) of DecanterChina.com may republish part of the content from the site without prior permission under strict Terms & Conditions. Contact china@decanter.com to learn about how to become an Official Media Partner of DecanterChina.com.

Comments

Submit